Why Join?

Who Should Apply?

Students, researchers, data scientists, engineers, product builders, and sustainability practitioners. Teams of 2–5 recommended (solo applicants welcome).

What We Provide

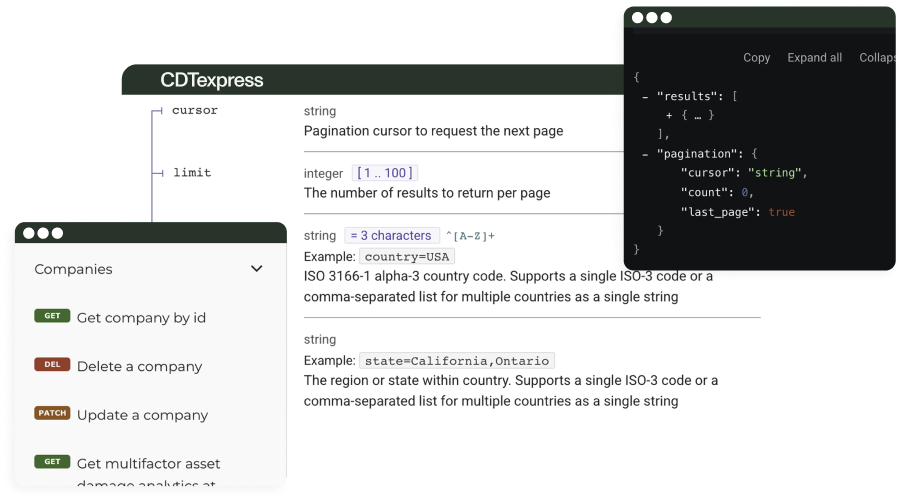

CDTexpress sandbox tenant with ample API credits

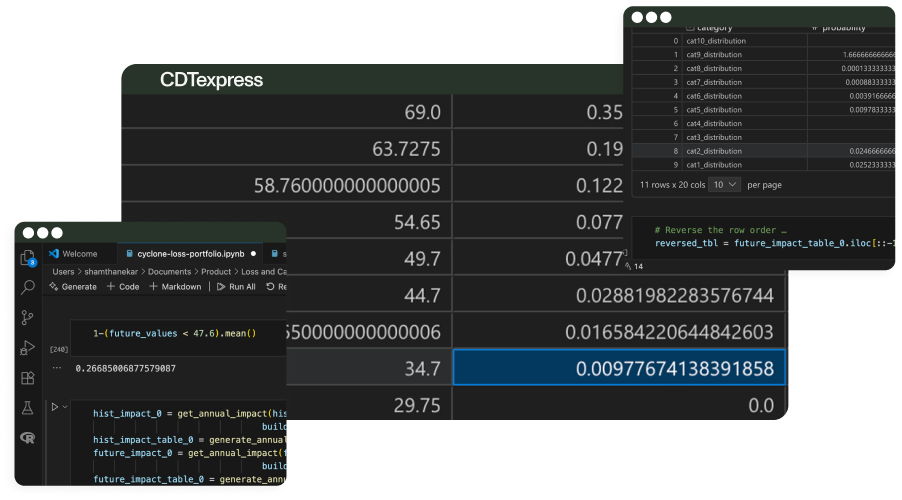

RiskThinking.ai Python SDK (pip installable)

Example notebooks that show common workflows

API documentation and quickstart guides

Slack/Email support during the build window and live office hours

The Challenges

Select from one of the problem statements below

Asset-level Physical Risk & Adaptation Planner (Toronto focus)

Goal: Turn high‑resolution hazard and vulnerability data into actionable adaptation guidance for buildings or infrastructure in the GTA.

Build a prototype that:

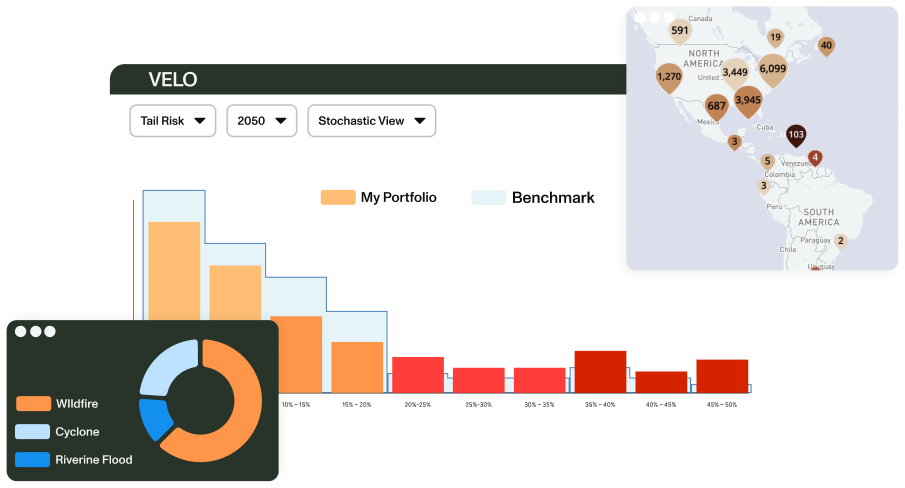

- Pulls asset‑level hazard exposures and impact metrics (e.g., heat stress, flood, wind) for current and future horizons (e.g., 2030/2050) under multiple scenario pathways.

- Computes risk scores and identifies top drivers (hazards, time horizons, locations).

- Generates prioritized adaptation recommendations (e.g., cooling upgrades, floodproofing) and, where possible, a simple cost/benefit or risk‑reduction estimate.

- Presents results in a clear interactive UI or notebook report (maps, tables, charts).

- Reproducible code/notebook + short README

- Example inputs (addresses/assets or public open‑data samples)

- A 5‑minute demo

- “Risk‑to‑Action” explanation: natural‑language justifications for each recommendation

- Simple ROI calculator comparing adaptation options

- Batch mode for many assets (CSV of addresses)

Minimum deliverables:

Stretch ideas:

Portfolio Climate Risk Insights for Canadian Equities

Goal: Build an analytics workflow that turns company + asset‑level data into portfolio‑level climate risk insights and scenario narratives.

Build a prototype that:

- Retrieves company and associated asset metrics

- Aggregates to portfolio views (by sector, geography, hazard, horizon)

- Highlights concentration of risk and what‑if scenarios (e.g., heatwave frequency increases; fluvial flood risk intensifies)

- Surfaces Top‑N drivers and actionable tilts (e.g., supplier diversification, facility adaptation priorities)

- Optionally exposes a natural‑language question interface (e.g., “Which holdings drive flood risk in 2035?”)

- Reproducible code/notebook + short README

- Example portfolio (ticker list or fabricated sample)

- A 5‑minute demo

- Interactive dashboard with filters (hazard, horizon, sector)

- Report generator (PDF/HTML) for investor or sustainability audiences

Minimum deliverables:

Stretch ideas:

Judging Criteria

Correctness & clarity of methods/assumptions

Impact & usefulness for real stakeholders

Effective use of RiskThinking.ai data/APIs

Technical execution & design (reproducibility, UX)

Storytelling (compelling demo and insights)